Learn About Loans, Credit, Finance and More with Aspire Money

Our blogs are filled with all the tips and tricks you need to learn about loans, credit, types of finance, and budget busters that will have you saving money in no time. We cover personal loans, homeowner loans, vehicle finance, methods of saving money, and everything in between! Have a read…

Browse Categories

How Do Millennials Manage Their Money?

Did you know that millennials earn less than their parents did at the same age? While it’s no secret that the cost of living is considerably more than it was thirty years ago, millennials still face far greater financial struggles than previous generations. So how do they manage their money?

LGBTQ Family, The Planning

Let's be real for a second, starting a family is not easy. Children can be quite demanding and VERY expensive. For a gay couple, those expenses could possibly be a lot more depending on the choice you make on where you want to start the journey, be it Adoption, In Vitro Fertilisation (IVF) or Surrogacy.

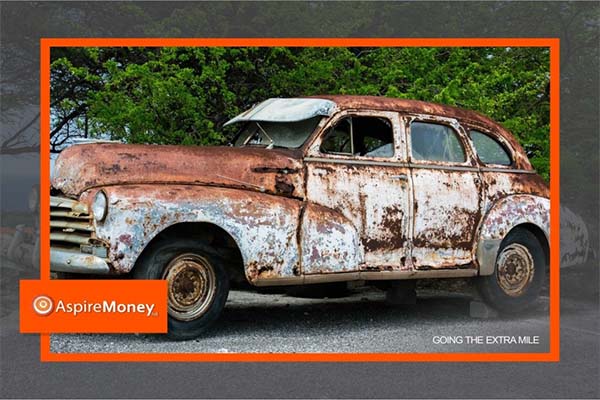

Blah Blah Car

It has reached that time in your life where you have to say your goodbyes to a loved one, they have been there to carry you when you’re down, they were there to see your first child come home from the hospital. But now it’s time for an upgrade with the family growing, now is the time for a new car

How to Keep Your Home Warm for Less This Winter

Near-freezing winter temperatures are not unheard of in the UK and the cold often has many holing up in their homes - the perfect place to keep warm this winter! Take a look at our tips below for some affordable home heating options...

Should you consolidate your debt if you have bad credit?

A debt consolidation loan lets you turn multiple debt payments – credit cards, store cards, overdrafts or loans – into one convenient payment. This type of loan is a good option if you want to reduce the total interest you pay on any outstanding debt by finding a loan with a lower interest rate.

How to get a car when you have bad credit

Having bad credit / history doesn’t mean you can’t borrow money to buy the vehicle you need, but it may mean some lenders won't approve your application.

Looking for a Loan?

At Aspire Money, we work hard with our panel of lenders to find you a suitable loan. Whether you are looking for a loan to cover home improvements, a new family car, or to consolidate existing debt, we can help you source a loan that suits your budget – even if you have a negative credit rating*! Find out more here

*Subject to Terms and Conditions

Representative Example: Annual Interest Rate (fixed) is 49.5% p.a. with a Representative 49.5% APR, based on borrowing £5,000 and repaying this over 36 monthly payments. Monthly repayment is £243.17 with a total amount repayable of £8,754.12 which includes the total interest payable of £3,754.12.

The %APR rate you will be offered is dependent on your personal circumstances.